crypto tax accountant canada

By following the tax rules outlined in this guide crypto investors in Canada are now finally able to report their. Ad TurboTax Tax Experts Are On Demand To Help.

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

100 Accurate Expert Approved Guarantee.

. Are you in need of a tax professional who specializes in bitcoin and cryptocurrencies. Theyre using this information to track Canadian crypto investors to ensure theyre reporting their crypto investments accurately and paying their fair share of crypto tax. Do you need help from a professional with filing your crypto taxes.

Get started today and maximize your refund. A brand new crypto tax appDeFi NFTs included. The Canada Revenue Agency cannot compel the production of information protected by solicitor-client privilege.

The official Crypto Tax Accountant directory. Our experts are well versed in calculating cryptocurrency transactions and its tax implications. We offer an extensive range of crypto taxation and accounting services tailored to the specific needs of our clients.

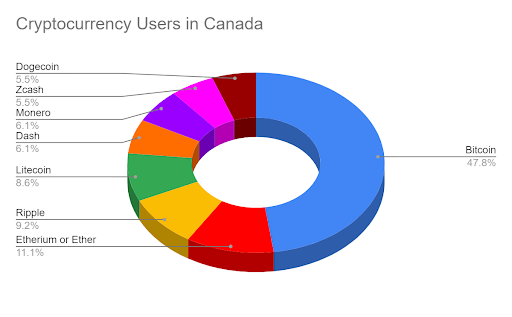

Our directory has tax accountants from the US Canada Europe Australasia and other parts of the world. What I found was easier is downloading only the trading and manually entering the depositswithdrawals. Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs.

Your communications with an accountant however remain unprotected. Will apperiacte greatly if someone can. Download Schedule D Form 8949 US only Reports and software imports eg.

Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet their tax obligations. For those wondering the Candian Revenue Agency has made it clear that yes Bitcoins and Cryptocurrencies need to be disclosed on taxes this year. Our directory of CPAs tax preparers and tax attorneys helps crypto traders help find a knowledgeable tax accountant for crypto tax advice planning and tax returns.

Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online. Success Accounting Services specializes in preparing cryptocurrency tax returns we review and inspect the Crypto Proceeds of Disposition Adjusted Cost Base ACB and Crypto Exchange Fees to ensuring its complete and accurate before E-Filing the tax returns. Whether you require cryptocurrency investment transaction reconciliations tax compliance tax return preparation and tax planning services.

The Canada Revenue Agency can track your crypto investments. We have developed the following resources to help you prepare for and manage the uncertainty they present. Download the CSV files manually and import them manually I used Koinlyio heard good things about cointracking too.

Deixis is a Canadian accounting firm specializing in crypto tax and accounting services for Canadian investors. Guide for cryptocurrency users and tax professionals. Look no further see our comprehensive list below of certified tax professionals including CPAs crypto accountants and attorneys that work with bitcoin and crypto taxation.

In other words solicitor-client privilege prevents the CRA from learning about the legal advice that you received from your tax lawyer. Because of this the Canada Revenue Agency CRA took on the task of understanding how to tax crypto assets and later published guidance to better guide Canadians through the complex tax landscape surrounding cryptocurrencies. Unit 210 12877 76 Avenue Surrey BC V3W 1E6 Canada GET STARTED.

How is crypto tax calculated in Canada. Best crypto tax accountant in canada SDG Accountant. There were less errors this way.

Check out the directory of tax professionals. Cryptocurrency is taxed like any other investment you make in Canada. Looking for a professional cryptocurrency tax accountant.

In Canada chain splits and hard forks such as the Bitcoin Cash BCH hard fork in 2017 do not automatically trigger tax. The Senate reviewed the issue of taxation on cryptocurrency in 2014 and recommended action to help Canadians understand how to comply with their taxes which the. That is because I dont deposit and withdraw very often.

We are one of the first blockchain accountants in Canada and have been working with a lot of different companies from the team of Ethereum to bitcoin mining companies investors developers crypto exchanges and other blockchain start-up ventures. CPA Canada is committed to helping professional accountants understand the strategic importance of emerging technologies such as blockchain and crypto-assets. You dont have to pay tax simply for owning crypto even if your assets increase after a hard fork or similar event.

TurboTax TaxACT and HR Block desktop 9999999e06. We are leading crypto tax accountants in Toronto. 50 of any gains are taxable and.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada.

Coming Soon - CoinLedger. 14 votes 17 comments. You only pay tax when you dispose of crypto by sale trade exchange or some other method.

Crypto-assets Business and accounting. Book a call today to discuss your. MetaCounts is a Vancouver Based Crypto accounting firm utilizing cutting-edge technology to provide a much-needed human experience to its clients.

Hi all i am looking for a tax adviser with a good knowledge of crypto tax filing. Want to reduce your tax owing. The CRA announced theyre working with crypto exchanges to share customer information.

Tax Partners is now offering specialized services for the blockchain industry.

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

The Ultimate Canada Crypto Tax Guide 2022 Koinly

How To Declare Cryptocurrencies On Your Taxes In Canada By Iskender Piyale Sheard Medium

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Cryptocurrency Taxes In Canada Cointracker

Best Crypto Tax Accountant In Canada Sdg Accountant

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Bitcoinca

Koinly Review Is It Good For Canadians March 2022 Updated

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Crypto Currencies Reporting And Taxation Maroof Hs Cpa Professional Corporation Toronto

Crypto Tax Accountant Canada Filing Taxes